Understanding Time Series Analysis

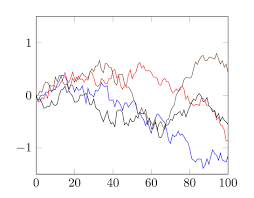

Time series analysis is a statistical technique used to analyse and interpret data points collected over time. It is a powerful tool in various fields, including economics, finance, weather forecasting, and signal processing.

One of the key aspects of time series analysis is the identification of patterns and trends within the data. By examining historical data points and identifying patterns, analysts can make predictions about future trends and behaviours.

There are several methods used in time series analysis, including moving averages, exponential smoothing, autoregressive integrated moving average (ARIMA) models, and Fourier transforms. Each method has its strengths and weaknesses, depending on the nature of the data being analysed.

Time series analysis is essential for making informed decisions based on historical data. For example, in finance, analysts use time series analysis to predict stock prices or market trends. In weather forecasting, meteorologists use time series analysis to predict future weather patterns based on historical data.

Overall, time series analysis is a valuable tool for extracting meaningful insights from time-dependent data. By understanding past trends and patterns, analysts can make informed predictions about future events and behaviours.

Essential FAQs on Time Series Analysis: Methods, Applications, and Challenges

- What is time series analysis?

- Why is time series analysis important?

- What are the common methods used in time series analysis?

- How is time series analysis applied in finance?

- What are the key components of a time series model?

- How do you identify trends and patterns in time series data?

- What are some challenges faced in time series analysis?

- Can time series analysis be used for forecasting future trends?

What is time series analysis?

Time series analysis is a statistical technique that involves examining and interpreting data points collected over a period of time. It allows analysts to identify patterns, trends, and relationships within the data to make informed predictions about future outcomes. By studying the sequential nature of the data, time series analysis helps in understanding how variables change over time and how they may be influenced by various factors. This analytical approach is widely used in fields such as economics, finance, weather forecasting, and signal processing to gain insights into historical trends and make forecasts for future events.

Why is time series analysis important?

Time series analysis is crucial because it allows us to uncover valuable insights and patterns hidden within time-dependent data. By examining historical trends and behaviours, we can make informed predictions about future outcomes. This analytical technique is essential in various fields such as finance, economics, weather forecasting, and signal processing, enabling us to understand and anticipate changes over time. Time series analysis helps us identify trends, seasonality, cycles, and irregularities in data, providing a solid foundation for decision-making and strategic planning. Ultimately, by harnessing the power of time series analysis, we can better understand the past, interpret the present, and prepare for what lies ahead.

What are the common methods used in time series analysis?

One frequently asked question in the field of time series analysis is: “What are the common methods used in time series analysis?” Time series analysis employs various techniques to analyse and interpret data collected over time. Some of the common methods include moving averages, exponential smoothing, autoregressive integrated moving average (ARIMA) models, and Fourier transforms. Each method has its own strengths and applications, depending on the nature of the data being analysed. These methods play a crucial role in identifying patterns, trends, and relationships within time-dependent data, enabling analysts to make informed predictions and decisions based on historical data trends.

How is time series analysis applied in finance?

Time series analysis plays a crucial role in finance by providing valuable insights into historical data trends and patterns that can be used to make informed decisions. In finance, time series analysis is applied to predict stock prices, market trends, and asset performance based on past data points. By analysing historical financial data using techniques such as moving averages, exponential smoothing, and ARIMA models, analysts can identify patterns and trends that help in forecasting future market behaviour. This information is essential for investors, traders, and financial institutions to mitigate risks, identify opportunities, and make strategic investment decisions in the dynamic world of finance.

What are the key components of a time series model?

When exploring the key components of a time series model, it is essential to consider three fundamental elements: trend, seasonality, and noise. The trend represents the long-term direction in the data, indicating whether values are increasing, decreasing, or remaining stable over time. Seasonality refers to recurring patterns or fluctuations that follow a specific time frame, such as daily, weekly, or yearly cycles. Lastly, noise represents random variations or irregularities in the data that cannot be attributed to the trend or seasonality. Understanding and accurately modelling these components are crucial for developing effective time series models that can provide valuable insights and predictions based on historical data patterns.

How do you identify trends and patterns in time series data?

In time series analysis, identifying trends and patterns in the data is a crucial step in making accurate predictions and informed decisions. One common approach to identifying trends is to use techniques such as moving averages or exponential smoothing to smooth out noise and highlight underlying patterns. Additionally, analysts often employ methods like autocorrelation analysis and decomposition to uncover seasonal patterns and long-term trends within the data. By understanding these trends and patterns, analysts can make more reliable forecasts and gain valuable insights into the behaviour of the time series data over time.

What are some challenges faced in time series analysis?

In time series analysis, several challenges can be encountered that may impact the accuracy and reliability of the results. One common challenge is dealing with non-stationary data, where the statistical properties of the data change over time, making it difficult to apply traditional analysis techniques. Another challenge is handling missing or incomplete data points, which can affect the overall analysis and forecasting accuracy. Additionally, selecting appropriate models and parameters for time series analysis can be challenging, as different models may be suitable for different types of data. Finally, interpreting complex patterns and trends within the data accurately can also pose a challenge, requiring careful consideration and expertise to derive meaningful insights from the time series data. Addressing these challenges effectively is crucial in ensuring the robustness and validity of time series analysis results.

Can time series analysis be used for forecasting future trends?

Time series analysis is a powerful statistical technique that can indeed be used for forecasting future trends. By examining historical data points and identifying patterns and relationships within the data, analysts can make predictions about future trends and behaviours. Through methods such as moving averages, exponential smoothing, ARIMA models, and Fourier transforms, time series analysis enables analysts to extract valuable insights from time-dependent data and make informed forecasts about future events. This capability makes time series analysis a valuable tool in various fields such as economics, finance, weather forecasting, and signal processing for predicting future trends with a certain degree of accuracy.

No Responses